H.M. Queen Máxima of the Netherlands capped a three-day trip to Kenya on Wednesday with an aim to advance safe, equitable, and affordable access to quality digital financial services — including savings accounts, credit, payments, and insurance — for every Kenyan. She was visiting in her role as the United Nations Secretary-General's Special Advocate for Inclusive Finance for Development (UNSGSA), focusing on how financial inclusion can enhance climate resilience, digital public infrastructure, and financial health (or well-being) in the country.

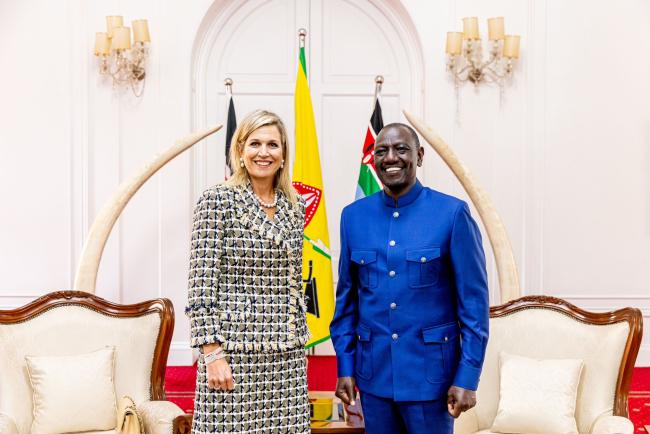

The visit started on Monday morning when Queen Máxima was in Kisumu, near Lake Victoria, to speak with local farmers who have harnessed digital financial services to grow more crops, earn more money, and shield themselves against climate shocks like floods and droughts. A key theme of discussions was the increasing importance of enhancing resilience against climate-related challenges and promoting overall financial health for more Kenyans. Afterward, the UNSGSA traveled to Nairobi, where the rest of her visit unfolded, including an afternoon meeting with President William Samoei Ruto (see more details from day one here).

On Tuesday, in Ngong, near Nairobi, Queen Máxima heard the inspiring journey of Esther Muthoni Karaya. A registered nurse and entrepreneur, Esther transformed her family residence into ZamZam Medical Services, a healthcare center primarily serving lower-income groups.

Facing challenges securing financing through traditional methods, Esther found a lifeline in PharmAccess's Medical Credit Fund (MCF) and its innovative digital loan product, Cash Advance. This product, developed in collaboration with CarePay, offers healthcare providers loans based on their mobile revenue, eliminating the need for traditional collateral. As a result, ZamZam's credit limit increased by over 400%, enabling Esther to expand the clinic, enhance its facilities, and provide better care.

Also, in Kawangware, Nairobi, the Special Advocate met with micro- and small-business owners from the area. These entrepreneurs shared their personal stories and insights on how digital financial services have transformed their daily financial management, empowered them to tackle risks, and opened doors for future investments.

By engaging directly with individuals and businesses, the UNSGSA harnesses their valuable insights as part of efforts to help promote financial inclusion initiatives. This included meetings with public and private sector leaders on Tuesday and Wednesday in Nairobi. Queen Máxima met with National Treasury and Economic Planning Cabinet Secretary Prof. Njuguna Ndung’u, Central Bank of Kenya (CBK) Governor Kamau Thugge, Ministry of Information, Communication and the Digital Economy Cabinet Secretary Eliud Owalo, and CEO of Equity Group Holdings James Mwangi. She also spoke with key stakeholders in roundtable meetings on inclusive green finance and open finance.

Queen Máxima used dialogue as an opportunity to underscore Kenya's progress in financial inclusion over the last decade — 79% of adults in the country have accounts in 2021, up from 42% in 2011 (World Bank Global Findex, 2021) — as well as to explore how she can support and collaborate on various inclusive finance initiatives such as financial health.

This is critical since financial health has declined in Kenya in recent years, meaning fewer people can manage their daily expenses or unexpected challenges despite improved access. Financial health is a key goal of financial inclusion. It empowers individuals and businesses in Kenya to manage finances, build resilience, save for the future, and confidently secure their financial well-being.

Additionally, Queen Máxima provided brief remarks for the United Nations Development Programme’s (UNDP) launch of its new report on digital financial services for equitable growth.

This was Queen Máxima’s second visit to Kenya as the Special Advocate. The previous visit was held in April 2010. Partners from the UNSGSA’s Reference Group supporting technical work on the visit included the Bill & Melinda Gates Foundation (BMGF), the Consultative Group to Assist the Poor (CGAP), and the World Bank Group.