The financial inclusion landscape in Kenya has transformed dramatically over the past decade. Today, the latest World Bank Global Findex Report notes an impressive 79% of Kenyan adults have bank accounts, up from just 42% in 2011. This leap is largely thanks to mobile money, which has made financial services accessible to millions.

Yet, the journey is far from complete. Data points to a stark reality: between 2017 and 2021, account ownership actually decreased from 82% to 79%, and around seven million Kenyan adults, especially women and the poor, remained on the periphery of the financial system. As more citizens grapple with escalating living and healthcare costs, the situation is compounded by a decline in financial health as Kenyans face ongoing daily financial management challenges.

The FinAccess Household Survey from 2021 underscores this trend, revealing that less than one in five Kenyan adults can effectively meet their financial needs, down from one in four in the preceding survey. Notably, when faced with environmental disasters, the reliance on informal financial coping strategies is evident, with formal financial services playing a minimal role.

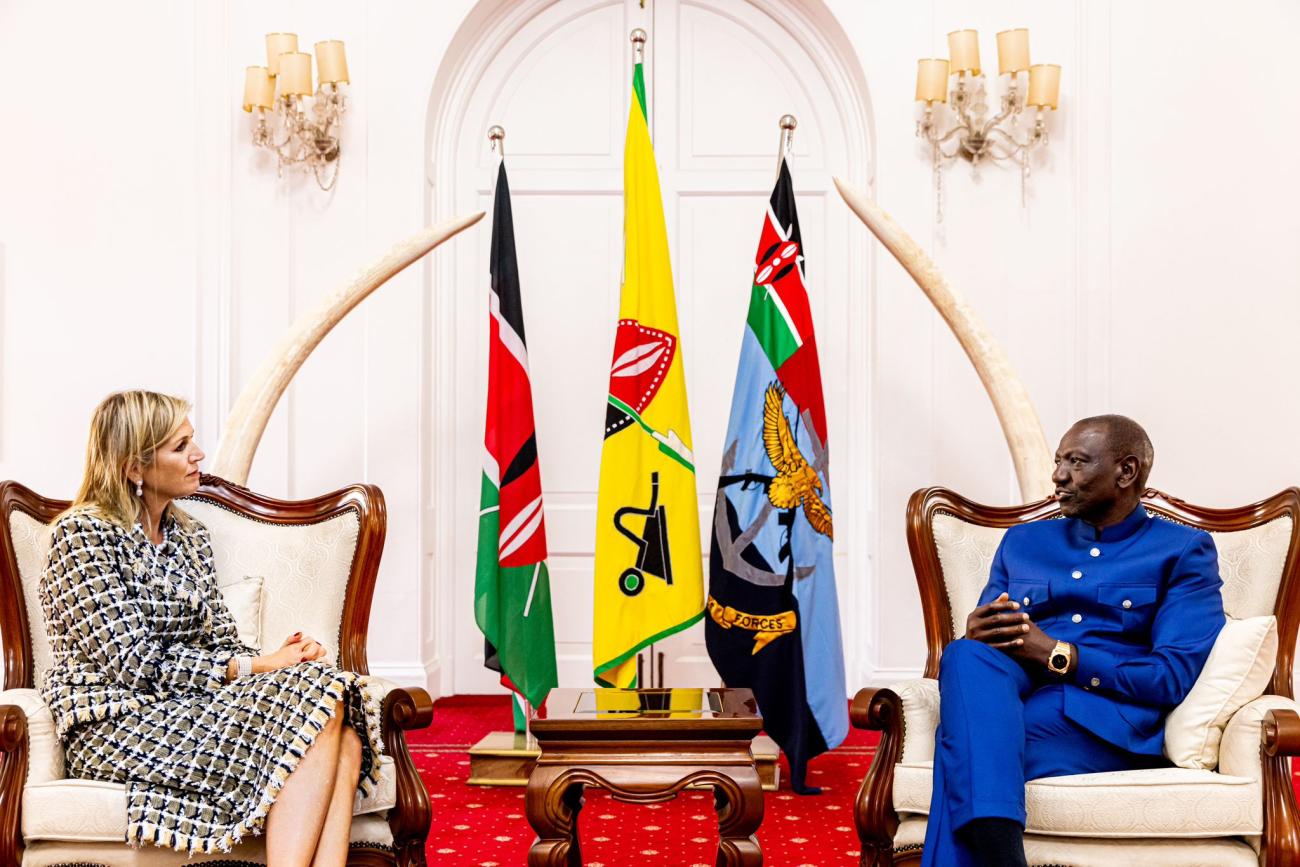

Against this backdrop, H.M. Queen Máxima of the Netherlands, the United Nations Secretary-General's Special Advocate for Inclusive Finance for Development (UNSGSA), visited Kenya from 23-25 October 2023. She aimed to delve deeper into the nation's financial inclusion and financial health issues to support efforts to catalyze action toward improving it. Engagements with President William Samoei Ruto, National Treasury Cabinet Secretary Prof. Njuguna Ndung’u, and Central Bank of Kenya (CBK) Governor Kamau Thugge, among others, underscored her commitment to this cause.

The UNSGSA’s field visits showed opportunities to enhance resilience and responsibly spur innovation. In Kisumu, she met with farmers who, through digital financial services paired with ag-tech platforms, have bolstered their agricultural resilience against climate extremes. In Ngong, outside Nairobi, the transformation of a home into a health clinic showcased the power of well-designed financial services to deliver productive digital credit. (Learn more in each of the following client stories).

>> Client stories

- Empowering Kenyan Smallholder Farmers: Pula's Game-Changing Digital Insurance

- Hello Tractor, is Revolutionizing Farming and Fueling Economic Empowerment Through Digital Financing for Smallholders in Kenya

- Enabling Quality Healthcare for Kenyans: Digital Financing Empowering Female Entrepreneurs to Better Serve Communities

Key Priorities

While in Kenya, Queen Máxima identified six pivotal areas where the country could boost financial inclusion, each with the potential to significantly enhance the nation's financial ecosystem:

1. Digital Public Infrastructure (DPI) as a Catalyst for Growth

The UNSGSA and President Ruto discussed the potential of DPI as a cornerstone for a more inclusive digital economy. They explored pathways for expanding digital financial services and their applications across various sectors—including health, education, and agriculture—emphasizing the importance of establishing DPI as a key policy objective. The UNSGSA offered to facilitate connections with global experts to support Kenya's DPI initiatives.

2. Making Mobile Finance More Accessible

The UNSGSA's conversations with key financial policymakers centered on the need for affordable mobile financial services. They discussed how expensive services can stop people from being able to participate in digital finance. They agreed it is important to look more closely at what makes these services expensive to help make them more affordable for everyone. This is especially important for underserved groups who often stand to benefit the most from mobile financial empowerment but are deterred by inaccessible pricing.

3. Open Finance as a Lever for Financial Diversification

Sharing experiences from Brazil and India, the UNSGSA illustrated the transformative impact of open finance. The UNSGSA and Cabinet Secretary Ndung’u discussed a feasibility assessment to explore how open finance can be enacted in Kenya and its potential to diversify financial offerings and deepen economic and financial well-being.

4. Advancing Consumer Financial Protection

Cabinet Secretary Ndung’u, Governor Thugge, and the UNSGSA discussed the importance of modernizing Kenya's financial consumer protection framework. Drawing parallels with successful initiatives in the WAEMU region, Queen Máxima advocated for work to be done to identify and address consumer risks in digital finance.

5. Elevating Financial Health in Policy Agendas

The UNSGSA encouraged Kenyan leaders, including President Ruto, Cabinet Secretary Ndung’u, and Governor Thugge, to elevate financial health as a critical component of policy and business strategy. They spoke about how to better understand the financial challenges Kenyans face, such as through an evaluation, and how to use this knowledge to make sure that policies and business practices help improve people's financial lives. Additionally, the UNSGSA recommended leveraging FinAccess Survey insights to inform policymaking. She underscored the need for comprehensive financial health metrics to ensure policies effectively address citizens' financial challenges.

6. Incorporating Inclusive Green Finance (IGF) into National Priorities

In discussions with President Ruto and key cabinet members, the UNSGSA spoke about how IGF can be adopted as a central goal within Kenya's national strategies. The dialogue covered how Kenya's experience in sustainable banking could be harnessed to embed IGF within its policy frameworks, advocating for a special fund under the Credit Guarantee Scheme to promote green initiatives.

UNSGSA Partners in Kenya

The UNSGSA's visit was supported by select Reference Group partners and a broader delegation, including the Bill & Melinda Gates Foundation, the Consultative Group to Assist the Poor (CGAP), the Financial Sector Deepening Kenya (FSD Kenya), the United Nations Development Programme (UNDP), the United Nation Resident Coordinator’s Office in Kenya, and the World Bank.