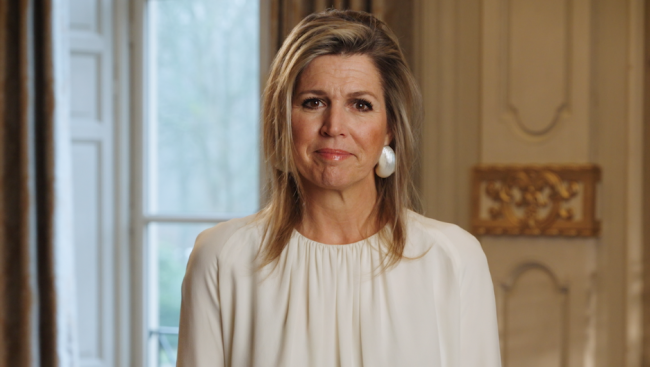

H.M. Queen Máxima of the Netherlands, in her capacity as the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development (UNSGSA), provided pre-recorded video remarks for the First Plenary of the G20 Global Partnership for Financial Inclusion (GPFI) held on 15 March 2024 in Brasilia, Brazil.

--

Ladies and Gentlemen,

As we gather for the G20 Global Partnership for Financial Inclusion, it is with a deep sense of appreciation that I reflect on the transformative achievements we have realized. The GPFI has been a pivotal force for change, expanding the scope of financial services to reach billions worldwide.

This year, we press forward with sharp focus on financing for MSMEs, addressing the challenge of last-mile access, and the essential goal of financial health. To this end, let us recognize the Brazilian Presidency for incorporating financial health into the GPFI's priorities, emphasizing the critical relationship between financial inclusion and financial health.

Let me share with you the story of Luisa Pereira, a ride-hailing app driver I met last June in São Paulo. Luisa illustrates the impact that effective financial services can have in empowering people to succeed. After her divorce and the subsequent loss of her vehicle, Luisa struggled to support her family. She discovered a new path with Kovi, a company that presented a novel approach to auto financing.

Kovi's rent-to-own model, tailored for underserved communities, including those with lower incomes and women. It allowed Luisa to afford her own vehicle. This opportunity not only enabled her to thrive as a ride-hailing driver but also to invest in her son's education.

Luisa's experience reminds us that our mission goes beyond facilitating access. It is about ensuring that these services meet people’s needs and lead to improved life outcomes.

Although more than three-quarters of adults worldwide now enjoy access to formal financial services, this access does not guarantee improved financial health. Evidence from various countries — spanning from Brazil, Kenya, the United States, and South Africa — strikingly illustrates this disconnect.

In both developed and emerging economies, many face financial hardships, from coping with unforeseen expenses to the burden of household debt. Furthermore, challenges such as climate change and inflation are adding to these financial strains, making it harder for people to achieve manage day-to-day finances and plan ahead.

However, financial products that are designed to bolster financial resilience and future investments, such as insurance and savings, have not seen broad adoption. This discrepancy underscores the urgent need for financial services that address immediate concerns as well as enhance long-term financial health.

It is not enough to simply open the doors to financial services. We should work together to enhance people's financial health. This means they need the necessary financial tools to effectively manage daily expenses, withstand financial shocks, achieve their financial goals, and gain confidence in their financial lives.

With the GPFI embracing this crucial challenge, let us deepen our understanding and commitment to financial health. And let stories like Luisa’s inspire us to work together to forge a future where financial inclusion serves as the bedrock for the economic prosperity of everyone.

Thank you.