Speech to the Financial Resilience Throughout Life symposium

Señor Gurría, Mr Dijsselbloem, Mr Knot, ladies and gentlemen, welcome to Amsterdam!

As you may know, this city is an important center in the history of modern finance. It is home to what is regarded as the oldest stock exchange in the world and the birthplace of the first multinational corporation: the Dutch East India Company, founded in 1602.

Amsterdam was also the home of one of the earliest promoters of financial literacy: John Adams. You all know him as the second President of the United States. But before he became President, he was U.S. ambassador to the Dutch Republic,and lived here in Amsterdam.

John Adams was one of the first people who saw the need for financial education. In a letter to Thomas Jefferson – written in 1787 – he illustrated the importance of financial resilience throughout life in glowing terms. He wrote: “All the perplexities, confusions, and distresses in America arise, not from defects in their constitution or confederation, not from a want of honor or virtue, so much as from downright ignorance of the nature of coin, credit, and circulation.”

Today, 230 years later, we have come a long way in tackling this ignorance. You are all working very hard to promote responsible financial behaviour in your countries. International organizations like OECD, G20, the World Bank and the United Nations are also pulling their weight. As the UN’s Secretary General’s Special Advocate for Inclusive Finance for Development, I have the privilege of working with you all to give people the financial tools and skills they need to improve their lives.

My focus, like yours, is development. We are working towards the same goal: reducing poverty and increasing opportunities for both individuals and communities. We know that people with access to financial services and financial skills stand more firmly in life. They are better prepared for risks and can better withstand hard times. Financial resilience improves their well-being and gives them hope for a better future.

During my working visits to countries across the world, I meet many people who are living proof of this. Like the members of the Uniones de Crédito y Ahorro in Peru, the UNICA’s, small community groups whose members are helping each other by pooling savings and discussing financial planning and household management. Parents bring their children into the UNICA so that they can grow up learning the discipline of saving.

And the farmers I met in Ethiopia, who produce food for schools in their district, receiving training and coaching in return from the FAO. Each time, with just a little help, they can reach broader markets, step by step.

I am impressed by the achievements in financial education of many OECD- and non-OECD countries. India, for example, has extensive financial literacy and awareness programs for people who are not familiar with formal financial services. Local bank managers are organizing financial literacy camps in villages and small towns. Their message and teaching methods are geared to the customers’ perception of their environment. Like posters showing essential and non-essential expenditures.

Essential: housing, food, clothes, education. Non-essential: gambling and drinking.

Earlier this year, I was in Pakistan and met with representatives and clients of the Kashf Foundation. Kashf focuses on enhancing the role women can play in improving the economic status of their families. The foundation offers them small loans and delivers financial education trainings about products such as savings accounts and insurance. Clients told me that their businesses and household decisions have become more effective as a result of these trainings. These are all very inspiring examples.

What we have learned in the Netherlands and many other countries is the value of a joint effort of government, business community, academia and civil society. Unity is strength! Financial education is best served by a coherent, national approach.

Currently, more than 115 countries collaborate in OECD’s International Network for Financial education. Thirty-four of those countries are actively implementing a national strategy for financial education. Another 30 countries are in the process of developing one.

Of course, countries that are embarking on this journey can leapfrog by using the experiences of others. At the same time, each country requires its own approach, depending on the specific national context and its priorities. It is not one size fits all.

In South Africa, for example, many bereaved families spend large sums of money on the funeral for their deceased loved ones, and this often leaves them in debt. This sensitive issue is addressed in the national strategy in close collaboration with churches. A delicate and respectful approach!

Another effective example comes from Hong Kong. They use a model from the public health sector to reach out to vulnerable groups in the population. It assess which groups are at risk and susceptible to interventions. So this shows that the local context is very important in designing strategies.

The Netherlands has had a national strategy since 2008. One of our more successful initiatives is the National Money Week, in which the majority of Dutch primary schools now participate. Thirty-four countries in Europe and over 130 countries worldwide have adopted this idea.

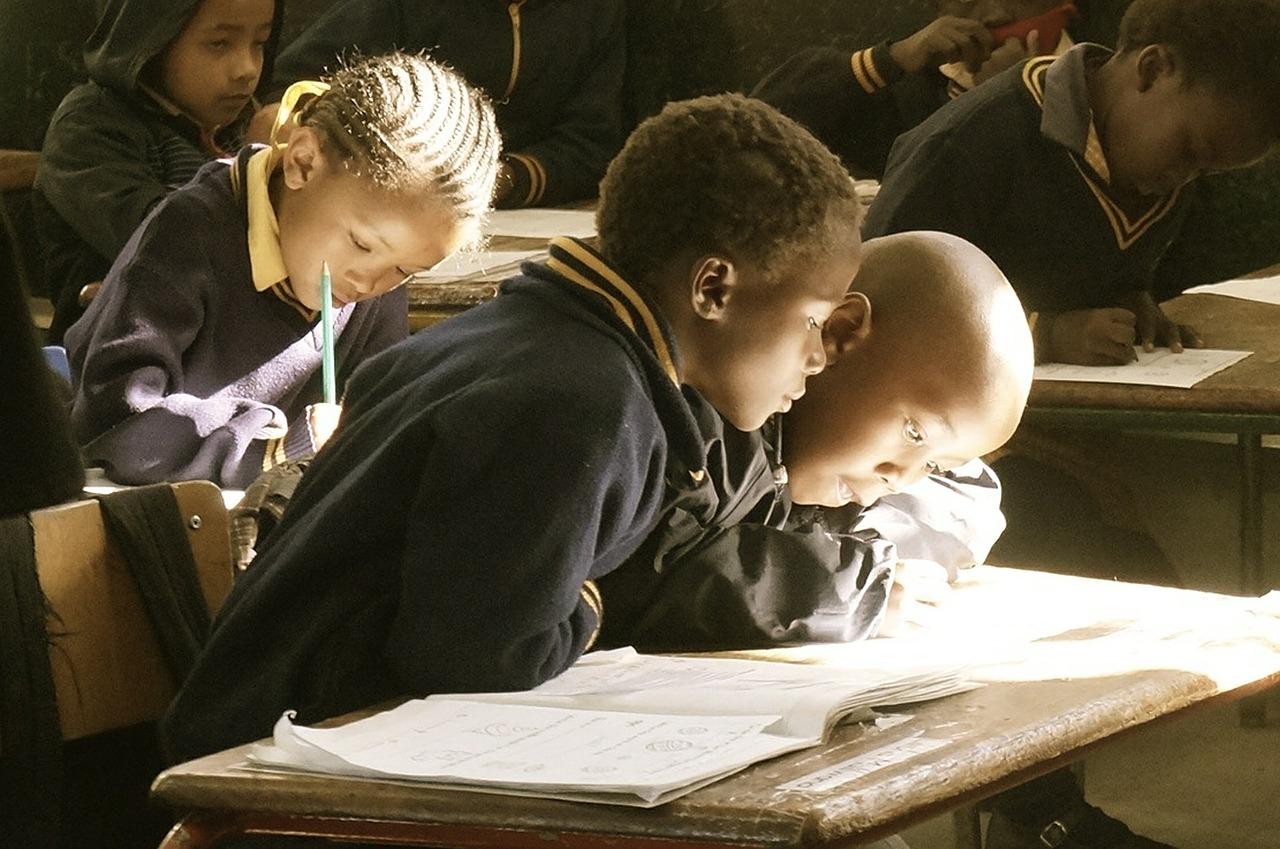

In addition, financial competencies are going to be integrated in the new school curriculum that is currently being developed in the Netherlands. Embedding financial skills is most effective if taught at an early age. We have to catch them young, as they say.

Wherever we live and whatever our approach, it is always important to keep learning from experience. There is a pressing need for research to provide insight into what works best. There is a pressing need for research to provide evidence of what works best. Countries that are leading the way in monitoring the effectiveness of financial education programs, include Morocco, Brazil and the U.S.

A comprehensive study in Brazil has shown that their programs improve the saving and borrowing behaviour of the younger generation. In the U.S., research has been done on how children absorb information. This has been very useful for adapting the manner in which children can be taught financial skills.

Having said all this, education is not a silver bullet. Financially literacy needs to go hand in hand with access to financial services and effective consumer protection. In the EU member states, a lot has been done to improve regulation in order to better protect consumers, and I hope the European Commission can play a role in making financial education part of the equation.

Ladies and gentlemen, seven hundred million people have gained access to financial services in the last three years. Thanks to innovations in products and delivery—like digital banking—millions are gaining access to bank accounts, insurance and many other services for the very first time. Digital services are accessible wherever and whenever you need them and they are affordable and reliable.

This, of course ,opens a broad range of financial services to more and more people, making it easier for them to invest in themselves, their children, their home, their business and their future. We all welcome this prospect as it has a positive effect on people's lives.

But digital finance also poses risks. When money becomes less tangible, it can become more difficult for people to manage their budget. And big data has large potential benefits, but can also be used to exclude vulnerable groups from insurance or credit.

So, for consumers and entrepreneurs to get the full benefit of financial products, they must understand their choices and rights. They need the right skills and financial awareness to become discerning customers who make sound decisions based on their personal situation. In short: they must be “money wise.”

John Adams was absolutely right. We need to understand ‘the nature of coin, credit and circulation’ to be financially resilient. We need it to improve our lives, to strengthen our communities and to boost our economies.

I am confident that you will use the opportunity of this symposium here in Amsterdam today to inspire each other to go forward! I wish you every success.