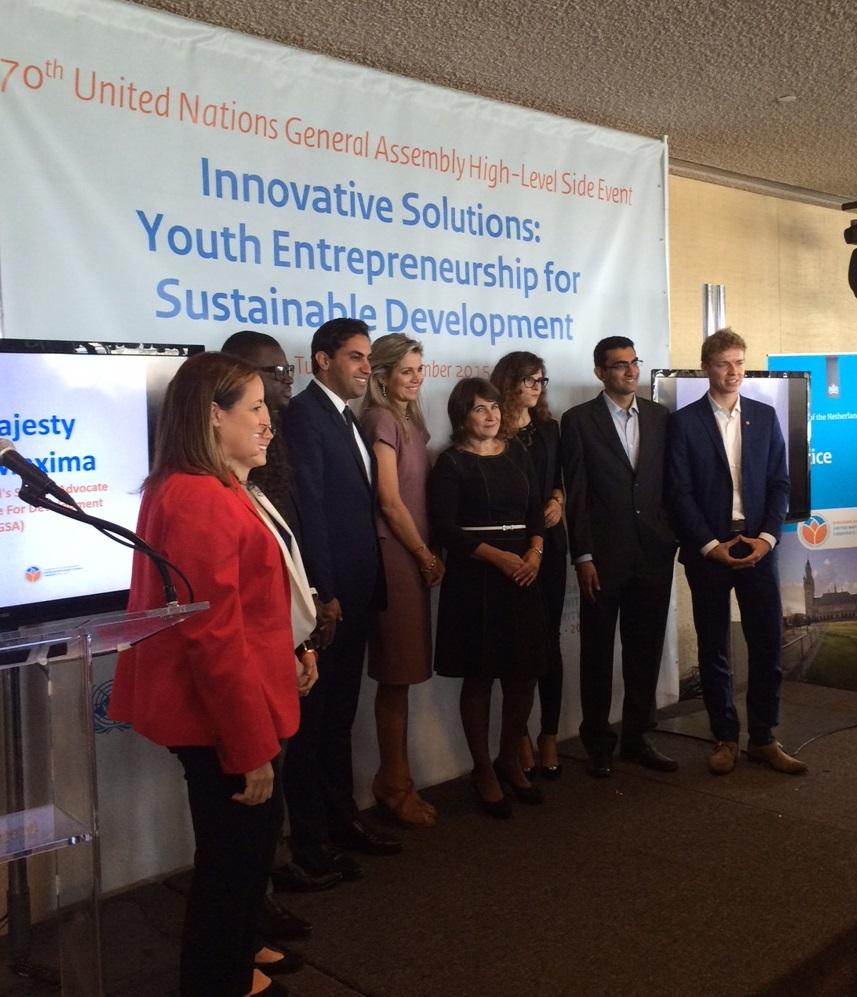

Informal Remarks at UN General Assembly, Side Event: Innovative Solutions: Youth Entrepreneurship and Sustainable Development

Minister Ploumen, Mr. Alhendawi, Mr. van Schayik, young entrepreneurs, ladies and gentlemen,

It is very encouraging to see all of you here today and to know that together we are working to ensure that young people gain the opportunities they deserve.

We need the energy and dynamism of young people to achieve the newly adopted 2030 Sustainable Development Goals. It is vital that they be given the support and tools they need to make an impact.

The right support is particularly important for young people who wish to become entrepreneurs, as many of our inspirational speakers today are. I salute your entrepreneurial spirit! Setting up your own business takes a bit of courage. It is an adventure! But it is also a powerful tool that can enable you to achieve your dreams.

All young people who are inspired by the idea of setting up their own business deserve a fair chance. Unfortunately many of them cannot take the leap because they lack access to financial services.

Fifty-four percent of youth ages 15-24 do not have a basic account. Over the past ten years there have been significant efforts towards advancing financial inclusion targeting the youth. Many financial services providers, governments, multilateral organizations, donors and NGOs, have been providing support. Take YouthStart for example, a partnership between UNCDF and the MasterCard Foundation to provide financial services for the youth in sub-Saharan Africa. Another example is the MoneyWise Platform in the Netherlands, which facilitates financial education with the involvement of governments, private sector, non-profits and schools.

Despite these and many other excellent efforts, young people still face barriers in accessing financial services, among them legal, policy and regulatory restrictions. Many products and services either do not meet the needs of young people or are simply not accessible to them.

It is critical to educate and empower young people to enable them to become discerning customers and successful entrepreneurs.

I am encouraged that more than 20 countries have included financial education as key component of their national financial inclusion strategies. Some countries are also developing stand-alone financial education plans, many of which have a special focus on youth. I would encourage multilateral organizations, governments, and other actors to step up these kinds of initiatives.

Governments in particular can establish the right policy environment to encourage the development of innovative and affordable delivery channels focused on first time ventures of young entrepreneurs. The private sector can work on developing financial products and services geared toward young entrepreneurs. And all stakeholders can invest in the development and delivery of financial skills programs.

Addressing the challenges faced by all young people, including those who want to become entrepreneurs, should be a primary focus as we begin to implement the new Sustainable Development Agenda.

We must work to expand financial inclusion hand in hand with financial education so that youth can build a more secure and fulfilling future as they take the Global Goals forward. We always say the young of today are tomorrow´s future. They are also our present. I look forward to hearing our youth entrepreneurs. Thank you.