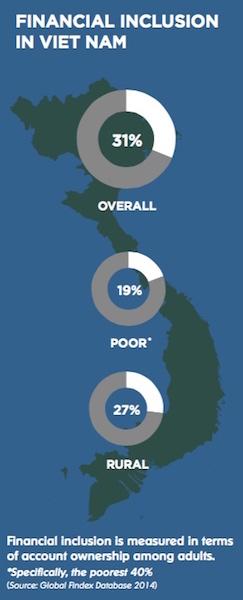

Within just one generation, Viet Nam has undergone an extraordinary transformation from being one of the world’s poorest nations to achieving lower-middle-income status. While financial inclusion has also increased sharply, the majority of Vietnamese still do not have a formal bank account.

Now, the country is looking to build on the progress of the past several years and to expand inclusive growth, including in key sectors such as agriculture and small business.

Strategy for success

At the invitation of Prime Minister Nguyen Xuan Phuc, the Special Advocate and her delegation visited Viet Nam in May/June 2017 to provide insight on the policy and regulation landscape and the nascent national financial inclusion strategy. She met with members of the public and private sectors and highlighted several focus areas for expanding financial inclusion:

• National strategy. The Special Advocate proposed a two-stage process for the strategy. The first step will be the creation of a draft outlining the overall objective and vision. Based on feedback, the next step will be to develop a strategy with a comprehensive action plan aligned with the country’s existing development plan.

• Finance for agriculture and small business. Agriculture employs 42 percent of the country’s workforce but receives only 10 percent of total financing. The UNSGSA recommended establishing an agri-finance task force to propose innovative ways to help farmers plan, develop, and finance their enterprises, including through value-chain financing. Similarly, she noted that small businesses need greater access to flexible financing.

• Technology-enabled financial services. Viet Nam has one of the highest rates of mobile phone usage in the region but demand for digital financial services is low. The Special Advocate recommended deploying more agents in underserved areas, adjusting regulation to facilitate digital payments, and opening the financial sector to non-bank providers.

The UNSGSA and her partners plan to work closely with Viet Nam to advance the goals set forth during this visit. This will include providing support during the creation of the national strategy, and offering guidance on topics including agent networks, alternative collateral for small business lending, and innovative agriculture financing.