The UNSGSA visit to Indonesia in August 2016 has helped spark renewed activity to expand financial services to excluded populations.

Indonesia’s dynamic growth over the last 15 years has helped cut poverty in more than half. Still, 40 percent linger right above the poverty line, their economic prospects in need of further protection. To build further on this progress, the government has made a commitment to extend financial inclusion to three-quarters of the population by 2019.

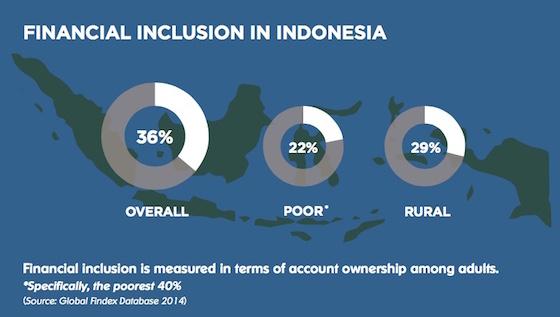

Reaching this milestone will not be easy, particularly given Indonesia’s vast geography of 922 inhabited islands. But some of the needed groundwork has already been laid. A broad range of financial institutions are serving low-income customers; regulatory reforms have encouraged agent banking, e-money, and other technological solutions; and the government is expanding internet access and mobile phone connectivity, digitizing the national ID system, and strengthening financial literacy. The percentage of adults with an account has almost doubled since 2011 but 64 percent still do not have access to financial services.

Way forward

At the invitation of President Joko Widodo, Queen Máxima and her delegation visited Indonesia in August 2016 with the objective of helping to accelerate financial inclusion. After meetings and discussions with customers, businesses, and policymakers, the UNSGSA made two primary recommendations:

National strategy

President Widodo signed the national financial inclusion strategy during the UNSGSA’s visit. In their discussion they agreed on the importance of high-level leadership, private-sector involvement, and ministerial coordination to implement the strategy. Throughout her visit she encouraged establishing accountable working groups, numerical targets, and systems to monitor success—tools she has found to be indispensable for driving progress.

Digital financial services

Digital technology offers the greatest opportunity for Indonesia to provide financial services to the poor, and to isolated and rural populations. Currently less than one percent of Indonesians use mobile money. To push digital finance far higher, the Special Advocate highlighted several opportunities:

• Create a level playing field so that all providers, including MNOs, can compete to provide financial services;

• Develop a digital payments infrastructure with full interoperability so that customers of all financial institutions can easily transact with each other;

• Significantly increase the number of banking agents serving isolated communities;

• Develop customer-centric services to ensure usage;

• Transform government-to-person payments from cash into digital. Government social welfare assistance reaches 15.5 million households but only 16 percent receive payments into accounts. Changing this represents the kind of low-hanging fruit that can fuel progress.

Next steps

Indonesia has moved forward quickly in the last year. The National Financial Inclusion Council Secretariat was established and working groups are being staffed. The main two regulators of financial providers have agreed to harmonize e-money and agent regulations; they have already streamlined licensing so that agents can serve both sets of customers, with plans to extend harmonization to products as well. Partners like the Better than Cash Alliance, the Gates Foundation, Women’s World Banking, and the World Bank are involved in supporting local stakeholders. Step by step, progress is unfolding.